How Credits and Incentives Help Business Invest in Their Own Communities

By Laurence Barral

Learn how government tax credits and incentives save business money, create jobs, and encourage economic growth

Being a good corporate citizen is not just a slogan. Every successful business serves the needs not only of its clients and employees, but also of the surrounding communities where they operate.

Those needs are varied, including tax revenue generation, commerce, economic development, jobs, housing, a clean environment, public safety, a strong sense of community, and more.

Businesses can help meet the needs of their surrounding communities by taking advantage of many government-sponsored credits and incentives (C&I) that are available to them. These programs allow businesses to put money back into their budget, and in doing so, help their community grow and prosper by creating jobs and revenue.

FICA Tax Tip Credit

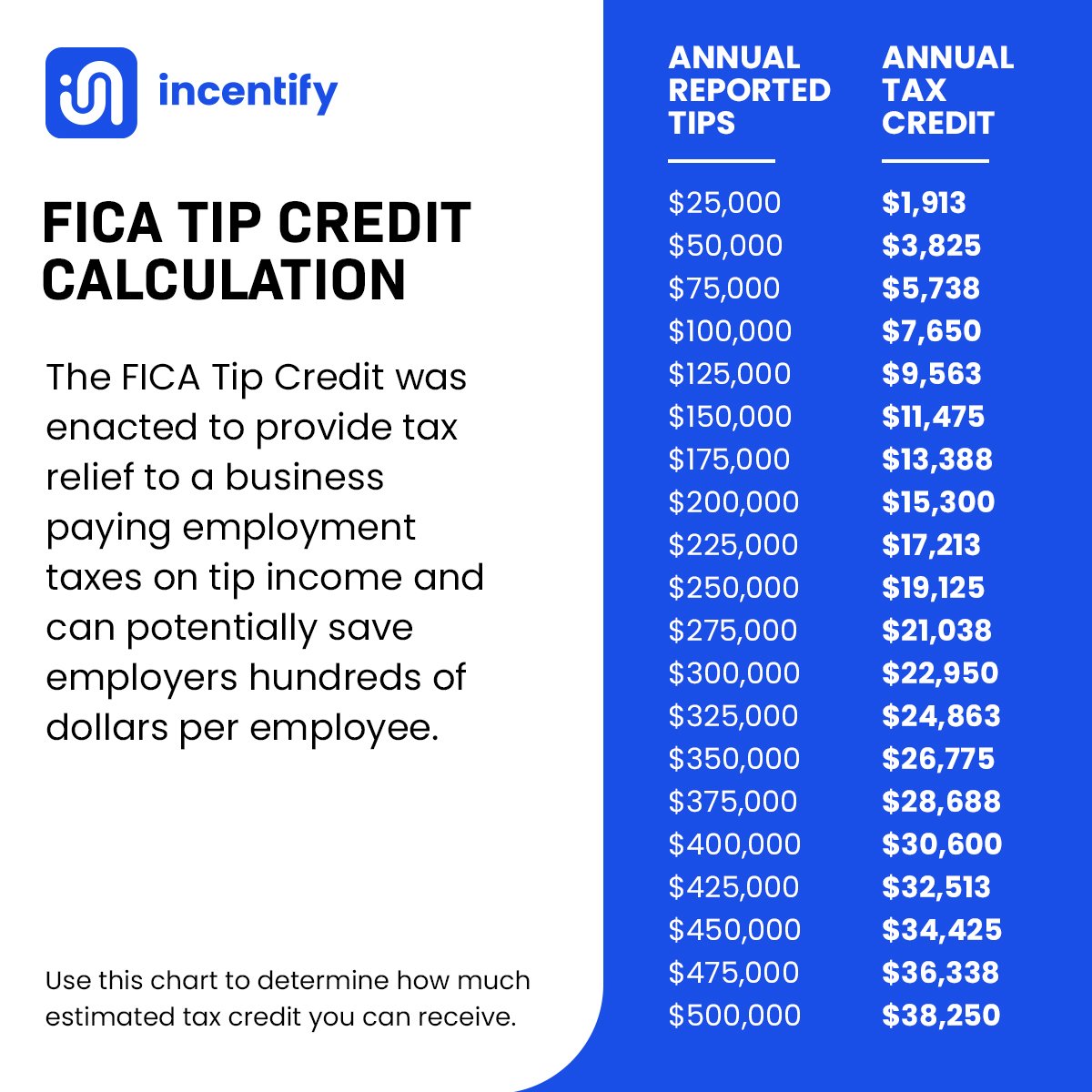

For example, the FICA Tax Tip Credit is a federal tax credit available to businesses that have employees who receive tips. If you operate in the food and beverage industry, this credit could reduce your tax liability, and be a game-changer for your business. It allows you to receive a credit on a portion of the Social Security and Medicare taxes that you pay on behalf of your employees who receive tips, up to a maximum of 7.65% of their tips.

To qualify for the FICA Tax Tip Credit, a business must meet several criteria:

Your business must have employees who receive tips

As an employer, you must have paid Social Security and Medicare taxes on those tips

The tips must be reported to you by your employees

The credit may only be applied to tips that exceed the amount that brings the employee’s wage up to the federal minimum wage, which is set at $5.15

Tips are an attractive income enhancement for many employees in the hospitality industry, and the FICA Tax Tip Credit can be a significant tax savings for businesses that retain employees who earn tips. By providing an incentive to employers for having tip earning positions on their payroll, the credit helps businesses create job opportunities and put income back into the community.

Work Opportunity Tax Credit (WOTC)

The Work Opportunity Tax Credit (WOTC) is another tax credit that helps businesses and the communities they serve. The credit is available to businesses that hire employees from certain targeted groups who face barriers to employment, such as veterans, ex-felons, and individuals who receive government assistance.

The credit is equal to a percentage of the wages paid to the employee during the first year of employment, up to a maximum of $9,600 per employee. The percentage of the credit varies depending on the targeted group the employee belongs to.

To qualify for the WOTC, the employee must meet the following criteria:

They must be a member of a targeted group

They must work at least 120 hours for the employer

The employer must submit additional forms to the state workforce agency within 28 days of the employee’s start date

The WOTC can be a win-win for employers and employees. Employers can save money on their taxes while providing job opportunities to individuals from the surrounding community who may have difficulty finding employment.

Research and Development Credit

The Research and Development (R&D) Tax Credit is available to businesses that invest in research and development activities. The federal credit is designed to encourage businesses to invest in innovation and technology, which can lead to new products, processes, and services.

The credit is equal to a percentage of the qualified research expenses (QREs) incurred by the business during the tax year. QREs include wages paid to employees who perform research and development activities, supplies used in the research and development process, and contract research expenses.

To qualify for the R&D Tax Credit, the business must meet the following criteria:

The research and development activities must be intended to create new or improved products, processes, or services

The activities must involve a process of experimentation

The activities must be technological in nature

The activities must be conducted in the United States

The R&D Tax Credit can be a significant tax saving for businesses that invest in research and development, and by encouraging investment in additional economic activity, including the hiring of outside firms, it helps create economic activity and growth in the community.

Incentify Helps Business Identify Tax Credits and Incentives that are Good for the Community

Identifying and applying for these valuable tax credits is not something that all businesses can easily do. As the nation’s leading enterprise tax credits & incentives (C&I) platform, Incentify is uniquely capable of helping business owners determine their eligibility for these and many other tax credits. The software company’s innovative cloud solution helps businesses of all sizes across diverse industries save valuable time and resources, and maximize their cash flow, by identifying and maximizing their eligibility for government C&I.

Incentify brings together companies, specialty advisors, and technology to help customers collaborate and engage in the discovery of credits and incentives. We combine technology with a team of C&I professionals to collect assessment documentation and connect you with top industry advisors who are best suited to discover and secure credit and incentive opportunities.

Through Incentify Discovery we will collect business information and unique economic data, and run the data through our C&I opportunity discovery engine to uncover every potential opportunity. We will determine potential C&I opportunities, like the FICA Tax Tip Credit, the Work Opportunity Tax Credit, and the Research and Development Tax Credit and many more. By taking advantage of these and other credits, businesses can save money on their taxes and increase profits, and perhaps most importantly, become a valuable economic partner in the community.

Contact Incentify today to find out more about how government C&I can help your business and the communities you serve.

About the Author:

Laurence Barral, Vice President of Product

Laurence Barral is an experienced product leader working with our engineering team to deliver and elevate the Incentify user experience. Her expertise lies in product vision, product launches, strategic planning, user experience, research, talent management, and coaching.

When she is not drawing workflows on whiteboards, she is spending her time with her family and friends traveling abroad. She is an avid runner and stand up paddle boarder. Laurence holds two masters degrees respectively in Economics and Human Resources Information Systems.

FREQUENTLY ASKED QUESTIONS

-

The FICA tax tip credit is a tax credit provided to businesses that have employees who receive tips as part of their compensation. FICA stands for Federal Insurance Contributions Act, which is the law that requires employers to withhold Social Security and Medicare taxes from their employees’ wages.

Under the FICA tax tip credit, employers can claim a credit for the Social Security and Medicare taxes they pay on the tips that their employees receive. To be eligible for the credit, employers must meet certain criteria, such as:

Employing individuals who receive tips regularly as part of their job duties.

Reporting all tips received by employees to the IRS.

Paying Social Security and Medicare taxes on the tips that employees receive.

The amount of the credit is equal to the employer’s portion of Social Security and Medicare taxes paid on tips, up to the amount of the tips reported by employees. The credit is claimed on the employer’s annual tax return.

The FICA tax tip credit is designed to provide an incentive for businesses to properly report and pay taxes on their employees’ tips. By doing so, businesses can reduce their tax liability and increase their bottom line, while also helping to ensure that employees receive the benefits they are entitled to under Social Security and Medicare.

-

The FICA tax tip credit is a tax credit available to employers who have employees who receive tips as part of their wages. Employers in certain industries, such as the food and beverage industry, are more likely to have employees who receive tips.

To be eligible for the FICA tax tip credit, an employer must meet the following criteria:

Have employees who receive tips: The employer must have employees who receive tips as part of their wages. This can include waitstaff, bartenders, and other employees in the food and beverage industry, as well as certain other industries where tipping is customary.

Pay FICA taxes on employee tips: The employer must pay FICA taxes on the tips received by their employees. FICA taxes include both Social Security taxes and Medicare taxes.

Meet certain reporting requirements: The employer must have completed IRS Form 8027, which reports the total amount of tips received by their employees. Employers must also report tips to the employee on their W-2 forms.

Claim the credit on their tax return: The employer must claim the FICA tax tip credit on their federal income tax return, using IRS Form 8846.

The credit is calculated as a percentage of the FICA taxes paid on employee tips, up to a maximum of 7.65% of the tips received by employees. Employers can claim the credit for all eligible employees, including both current and former employees.

It's important to note that the FICA tax tip credit is a federal tax credit, and some states may have their own tax credits or incentives for employers who have employees who receive tips.

-

The WOTC tax credit, also known as the Work Opportunity Tax Credit, is a federal tax credit available to employers who hire individuals from certain target groups who have consistently faced significant barriers to employment. The credit is designed to encourage employers to hire individuals who may have difficulty finding work due to their personal circumstances.

The target groups that are eligible for the WOTC tax credit include:

Temporary Assistance for Needy Families (TANF) recipients

Veterans

Ex-felons

Long-term unemployed individuals

Supplemental Nutrition Assistance Program (SNAP) recipients

Social Security Income (SSI) recipients

Vocational rehabilitation referrals

Designated community residents

Summer youth employees

The amount of the credit is based on the wages paid to the eligible employees during their first year of employment, and it can be up to 40% of their first-year wages, with a maximum credit of $9,600 per employee. To qualify for the credit, employers must obtain certification from the state workforce agency or the Department of Labor that the employee is a member of one of the eligible target groups.

The WOTC tax credit can provide significant savings for employers who hire individuals from these target groups. By taking advantage of the credit, employers can reduce their tax liability and potentially increase their bottom line, while also helping to provide job opportunities for individuals who may face significant employment barriers.

-

The R&D tax credit, also known as the Research and Development tax credit, is a federal tax credit designed to incentivize companies that conduct research and development activities within the United States. The credit is intended to encourage innovation and investment in technology and scientific research.

The R&D tax credit is available to companies that engage in qualified research activities, which generally includes activities that seek to develop new or improved products, processes, or software. The credit is also available for activities that seek to eliminate uncertainty in the development or improvement of a product or process.

The amount of the credit is generally calculated as a percentage of qualified research expenses, which can include wages, supplies, and contractor expenses. The credit can be up to 20% of qualified research expenses, depending on the company's situation. In some cases, the credit can be even higher for companies that meet certain criteria, such as being a small business or a startup company.

To claim the R&D tax credit, companies must file IRS Form 6765 with their federal tax return. The credit can be used to offset both regular income tax and alternative minimum tax (AMT) liability.

The R&D tax credit can provide significant benefits to companies that engage in research and development activities. By taking advantage of the credit, companies can reduce their tax liability and potentially increase their bottom line, while also investing in the future of their business through innovation and technological advancements.

-

Companies that engage in qualified research activities are generally eligible for the R&D tax credit. The credit is available to companies of all sizes, including corporations, partnerships, and sole proprietorships, as well as certain pass-through entities such as S corporations and limited liability companies (LLCs).

To be eligible for the R&D tax credit, companies must meet the following four criteria:

Conduct qualifying research: The company must conduct research that is intended to develop or improve a product, process, or software, and that involves the elimination of technical uncertainty.

Incurred qualified expenses: The company must have incurred expenses related to the qualifying research, such as wages, supplies, and contract research expenses.

Have a business component: The qualifying research must be undertaken to improve the company's business component, such as products, processes, software, techniques, formulas, or inventions.

Pass the four-part test: The company must pass a four-part test that evaluates the nature of the research activities, the methodology used, the technological advancements sought, and the level of uncertainty involved in the research.

In addition to these criteria, small businesses with average annual gross receipts of less than $50 million for the prior three years may be eligible for a special simplified R&D credit calculation. This simplified credit calculation allows eligible small businesses to claim a credit of up to 14% of their qualified research expenses.

It's important to note that while the R&D tax credit is a federal tax credit, some states also offer their own R&D tax credits, which may have additional eligibility requirements.

-

For the purposes of the R&D tax credit, research and development (R&D) generally refers to work that is done to develop new or improved products, processes, or software. To qualify for the R&D tax credit, the work must meet four specific criteria:

Technological in nature: The work must rely on principles of physical or biological science, engineering, or computer science.

Performed for a permitted purpose: The work must be intended to create a new or improved product or process, or to improve the functionality, performance, reliability, or quality of an existing product or process.

Elimination of uncertainty: The work must be intended to eliminate technical uncertainty related to the development or improvement of the product or process. Technical uncertainty exists if the information available at the outset of the project does not establish the capability, method, or appropriate design of the product or process.

Process of experimentation: The work must involve a process of experimentation that is designed to evaluate one or more alternatives to achieve a desired result. The experimentation process can include techniques such as simulation, modeling, prototyping, or systematic trial and error.

Examples of activities that may qualify for the R&D tax credit include developing new products or processes, designing and testing prototypes, developing new software applications, or making improvements to existing products or processes. The R&D tax credit is available to businesses across a wide range of industries, including manufacturing, software development, biotechnology, pharmaceuticals, and others.

It's important to note that determining eligibility for the R&D tax credit can be complex, and businesses may benefit from consulting with a tax professional or R&D tax credit specialist to ensure that they are properly identifying and documenting eligible R&D activities.